Less to Taxes, More to the Ministry of New Life

Gifts of Stocks and Mutual Funds

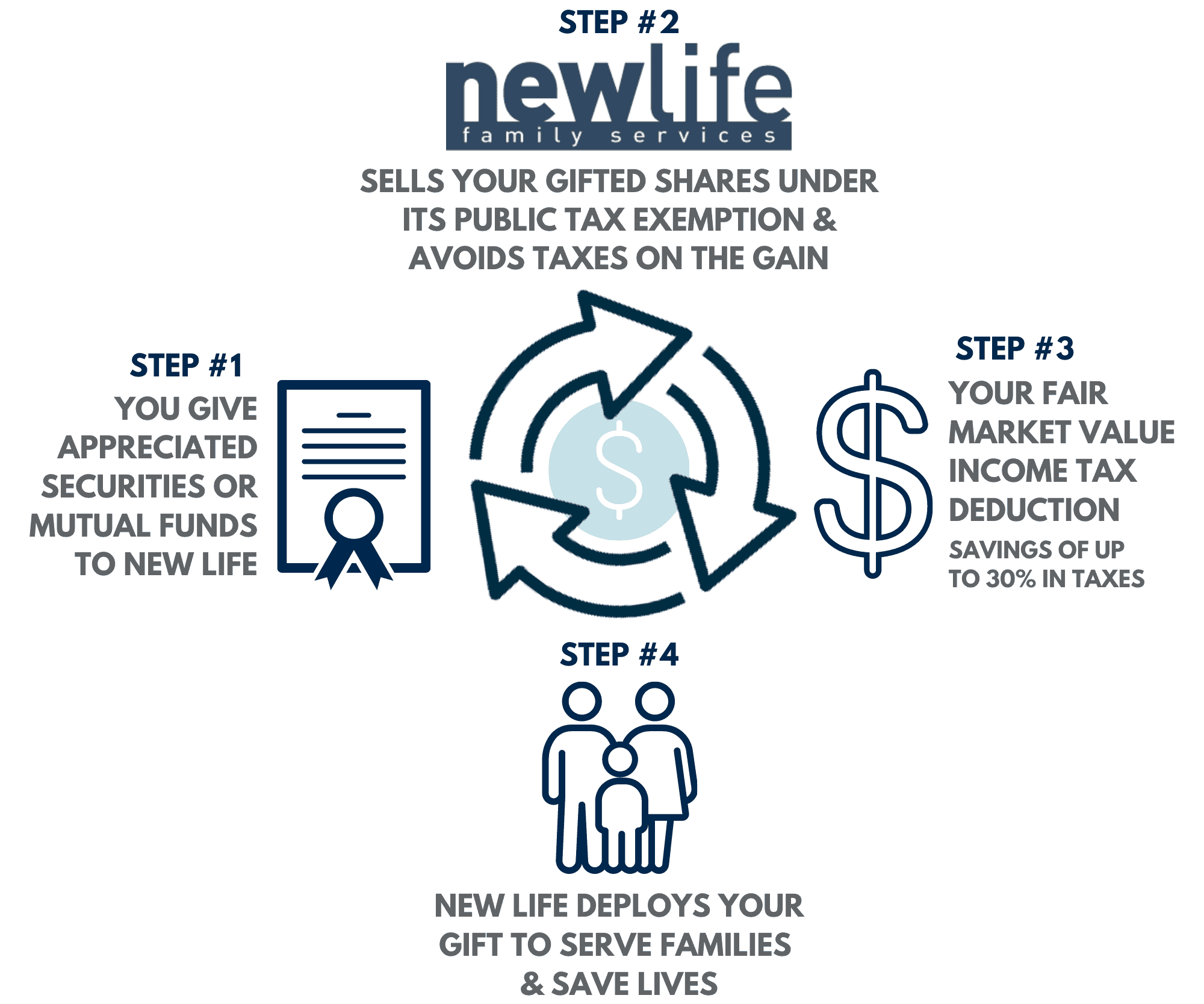

Did you know that appreciated stocks, mutual funds, and bonds in a taxable investment portfolio can be transferred as a gift to support New Life Family Services? Giving stocks directly to New Life provides a significant opportunity to avoid capital gains taxes, receive a deduction at the full market value of the securities, and ultimately maximize your charitable impact. The key concept to remember is to donate your stock or mutual funds BEFORE the sale. By doing this, you will ultimately reduce or completely eliminate capital gains taxes, which are the taxes on profits from the sale of an asset held for more than a year. This process typically involves coordinating with your financial advisor. For more information on giving stock to New Life, please contact Tammy Kocher, Executive Director, at tammy@nlfs.org or (612) 746-5664

Pay less tax: By gifting appreciated stock/mutual fund shares, you can minimize or eliminate your capital gain tax exposure on gifted shares.

Give more to charity: Additionally, any capital gain tax savings can be used to increase your charitable gift to New Life, thereby increasing your income tax deduction and cash flow.