Millions of Americans make donations of cash and property to the charities of their choice each year. However, many donors are left wishing that they could do more for the charities that they love and support. Life insurance can be an effective and convenient asset to give. There are various methods for making life insurance donations, each one having unique advantages.

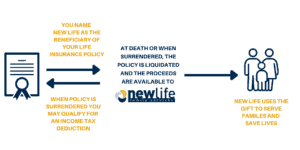

Naming the charity of your choice, such as New Life Family Services, as the beneficiary of your life insurance policy is the simplest way to provide our ministry with the death benefit proceeds from a policy.

If you aren’t completely sure how you want to distribute your assets after death, you can list New Life Family Services as a revocable beneficiary. This gives you flexibility in case your financial situation changes.

Naming a charity as a beneficiary also ensures the privacy of the transaction, which can be important for those who wish to keep their gifting intentions private from family members or other heirs. Transfer of assets from an insurance contract cannot be contested, making it impossible for anyone to stop the donation from occurring.

If you wish to leverage your cash donations to New Life, you can use life insurance to accomplish your goals. By either gifting a policy outright or naming New Life as beneficiary, you can provide our ministry with a large sum of money and provide a lasting legacy that honors the sanctity of human life for future generations to come.

For more information on gifting a life insurance policy to New Life, please contact Tammy Kocher, Executive Director, at tammy@nlfs.org or (612) 746-5664.